A holistic mindset for long-term growth

This content is categorized as:

Would you rather not lose $100 or find $100? If you’re like most people, you’d rather not lose $100. This is the concept of loss aversion, one of the common biases with retirement planning. With loss aversion, individuals are more sensitive to a loss of value than they are happy about a gain. What’s more valuable than your hard-earned cash? Applying the concept to investing, it’s natural to gravitate toward options shown to provide value, such as enhanced financial security. Focusing on the gain helps shift perspective away from a perceived loss, which is why not losing money can feel better than gaining the same amount.

When it comes to annuities, most people think about them as a tool to provide income. You pay an insurance company a sum of money that earns a fixed, guaranteed interest rate in exchange for regular income payments. In addition to income, annuities also offer opportunities to achieve more growth potential and boost your retirement savings.

Thinking holistically for the long term

Income is important for retirement, and maximizing growth opportunities as you’re saving is one way to secure more future income. As you accumulate money, you also want to safeguard what you have. But income and safety are only part of the picture.

Guarantees and potential growth

Growth completes the picture, so there’s enough money to retire to the life you want. A fixed annuity (FA) is an easy concept that offers a guaranteed, fixed interest rate for a period of years. When this accumulation phase ends, regular payments are disbursed. The risk is low, and the growth is modest.

| Fixed annuity (FA) |

Fixed indexed annuity (FIA) |

| Lower growth that’s guaranteed |

Higher growth that isn’t guaranteed |

A FIA carries a little more risk because the interest rate isn’t guaranteed. However, a FIA is still easy to understand and the principal is guaranteed. In exchange for a lump sum or periodic payments to an insurance company, that money is invested at potentially higher rates for higher returns. On top of growth potential, a FIA offers protection because neither the principal nor the earned interest can be lost to market fluctuation.

Getting ahead of retirement risks

Annuities like a FIA can help support growth objectives by managing retirement risks, such as:

- Longer lifespan – On average in the U.S., women are expected to live to age 80 and men to age 76. Many people will live longer than that with some reaching age 100 or more. A longer life means a longer retirement. A longer retirement means more time that your retirement assets need to last.

- Inflation and rising costs – Inflation reduces spending power, so dollars don’t stretch as far. Health care can be a significant line item in a retirement budget, and some of these costs, including prescription drugs, are expected to continue increasing through 2030. With rising prices, it takes more money to cover expenses.

- Market volatility – Experiencing significant negative returns can take a toll on savings, especially closer to retirement. Adding a FIA to your retirement portfolio is an efficient way to hedge against volatile markets and pursue growth opportunities to build your savings.

4 important FIA facts

- Money grows tax-deferred

- Higher potential returns than fixed rate alternatives

- Interest earned is locked in and can’t be lost to future market downturns

- Never earn less than 0%

How FIAs make growth possible

Because FIAs are tied to the performance of an external index like the S&P 500®, it helps drive growth with features selected by you:

- Custom index options – Custom indices were developed specifically for FIAs to maximize growth opportunities. By using advanced technology, predefined rules and automatic tracking to monitor performance, a custom index reacts faster to changes in the market.

- Crediting strategies – Your money’s growth is calculated using different crediting strategies tied to index performance, allowing you to diversify your dollars, reduce risk and benefit from potential growth in different indices. If there is no positive index return during a period of time, you would earn 0% in interest credits, but you also wouldn’t lose money.

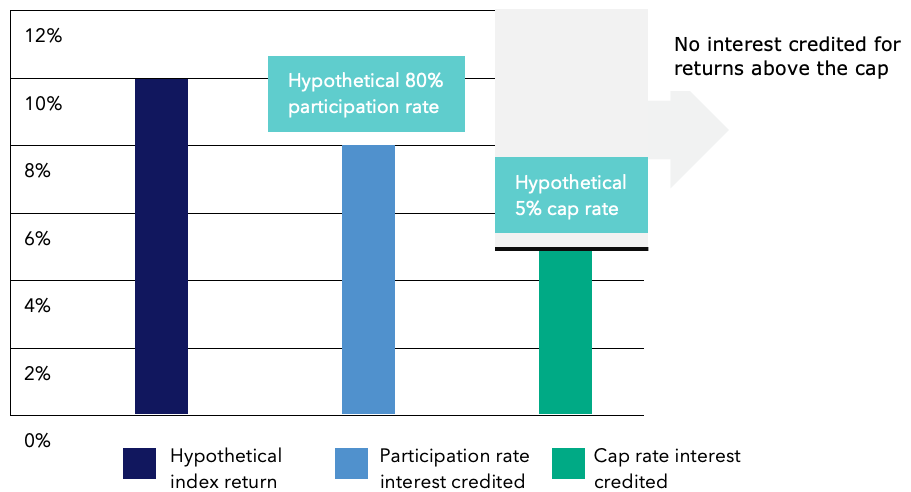

For example, participation rate is a strategy that credits a percentage of positive index returns. The higher the rate, the higher potential growth. Whereas with a cap rate strategy, interest for all positive index returns is credited up to a cap.

This hypothetical example is for informational purposes only and is not indicative of past, nor intended to predict, future performance of any specific annuity product or interest crediting method.

- Annual and multi-year strategies relate to how long index performance is measured. With a multi-year strategy, typically two years, there’s more time for an index to perform and potentially increase an annuity’s value more than one year with an annual strategy.

There are different annuities for different purposes, but looking at options holistically gives you a picture of their full value. The tax benefits, downside protection and growth potential — important in any holistic retirement savings strategy — can all be found in a FIA.

Talk with your financial professional before the next big market shift to see if adding a FIA to your diversified retirement portfolio would be a good way to help reach your financial growth goals.

Want the most from your retirement? Get smarter with Smart Strategies from Athene. Your source for tips, tools and financial solutions that can help you live your best life.

The S&P 500® (the “Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Athene Annuity and Life Company (“Athene”). S&P®, S&P 500®, US 500 and, The 500 are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Athene’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.