What can RILAs and VAs do for you?

This content is categorized as:

Which came first… the steam engine, the light bulb, the telegraph … or the annuity?

Many people assume the financial product would be far behind innovations that built the nation’s infrastructure. In fact, annuities have provided payments to families since the 1600s. Steam engines, light bulbs, and the telegraph came along more than a hundred years later.

Despite their longevity, annuities are often misunderstood. Why the stigma? There are a few possible reasons. Annuities are sometimes seen as complicated as there are many different types. Others may view them as risky or only for the very wealthy. But when you evaluate your retirement needs and goals and get a basic understanding of annuities, it’s easier to get a clearer picture of how annuities might fit in your retirement strategy. For now, let’s take a look at the solutions registered index-linked annuities (RILAs) and variable annuities (VAs) can provide.

RILAs and VAs serve different needs and risk tolerance

Like any financial product, annuities are right for certain circumstances, but may not be appropriate for all situations. As mentioned before, there are several types of annuities to fit different needs. Most people buy an annuity to help with long-term financial goals like generating guaranteed lifetime income, accumulating money for retirement or protecting money from market loss.

An important note is that all annuities are insurance contracts. In exchange for following the rules of the contract, a person will receive certain guarantees that are backed by the financial stability of the insurance company.

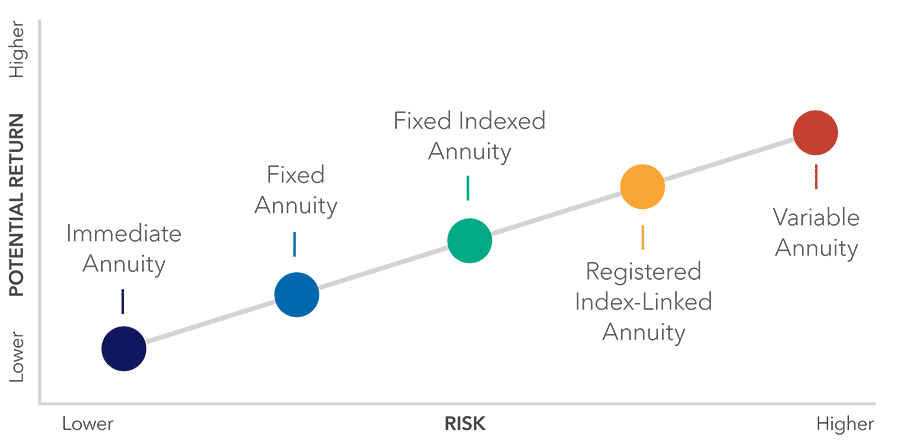

Another way annuities vary is by the amount of potential risk and return.

VAs allow for direct investment in accounts like mutual funds. While VAs offer higher growth potential, they also have higher risk than other annuities. People often buy variable annuities for their growth potential as well as for features that can help turn that growth into income during retirement.

RILAs are a newer type of annuity. People generally buy RILAs for growth potential, as they offer the opportunity to earn interest credits based in part on movement of a stock market index. Unlike a VA, RILAs have features that provide a measure of protection in case of market loss.

From a risk standpoint, a RILA can be described as a cross between a fixed indexed annuity and a VA. A RILA may be a good match for you if you want to limit your downside exposure but are willing to accept some market risk in exchange for more growth potential. It’s important to know your annuity “comfort zone” when it comes to your tolerance for risk.

After more than 400 years, annuities still deserve attention and understanding. Discuss your retirement goals with your financial professional to help determine if annuities are the right fit for you as part of a holistic retirement strategy portfolio.

This information is brought to you by Athene — where unconventional thinking brings innovative annuity solutions to help make retirement dreams a reality.

Guarantees provided by annuities are subject to the financial strength and claims paying ability of the issuing insurance company.

Guaranteed lifetime income is available through annuitization or an income rider. Income riders may be built into the contract or optional for a charge.

Indexed annuities are not stock market investments and do not directly participate in any stock or equity investments. Market indices may not include dividends paid on the underlying stocks, and therefore may not reflect the total return of the underlying stocks; neither an Index nor any market-indexed annuity is comparable to a direct investment in the equity markets.