Read time:

8-minute

article

Finding your footing after the "Great Resignation"

This content is categorized as:

During the pandemic in 2021, 47.8 million Americans voluntarily walked out on their jobs. So, what was behind this history-making exodus from the workforce called the "Great Resignation"? And more importantly, how has it impacted your clients and your business?

|

Discover insights from the Great Resignation that can help you assess clients' financial plans and navigate your own practice needs.

Download report

|

Why did workers call it quits?

Several factors came together, like the stars aligning, when workers began fleeing their jobs. There was still a fear of COVID-19 as one in three people quit their job for coronavirus-related reasons. There were also better job opportunities, career shifts and early retirements at play on top of fiscal stimulus and family reasons. Three years after the pandemic began, people are still resigning at the same, if not higher, rates than they did at the end of the pandemic’s first year.

8 factors behind the Great Resignation

- Fear of COVID-19

- Solid household finances

- Daycare/school challenges

- Fiscal stimulus checks

- Better job opportunities

- Need for better work-life balance

- Early retirement

- Career change

Where have your clients landed?

After the mass departure, most Great Resigners chose to retire early, change jobs, start a new business or take a break from working. If some of your clients got swept up in the trend, here are some ways you can offer valuable expertise to make sure they are financially on track and staying that way.

Early retirement

The oldest baby boomers became eligible for Social Security benefits in 2008 when they first turned 62, and retirement rates have risen since then. In August 2021 during the pandemic, about 3 million Americans retired earlier than they planned, some for health and safety concerns. For others, rising asset values made it possible.

|

How can you help clients who want to retire early?

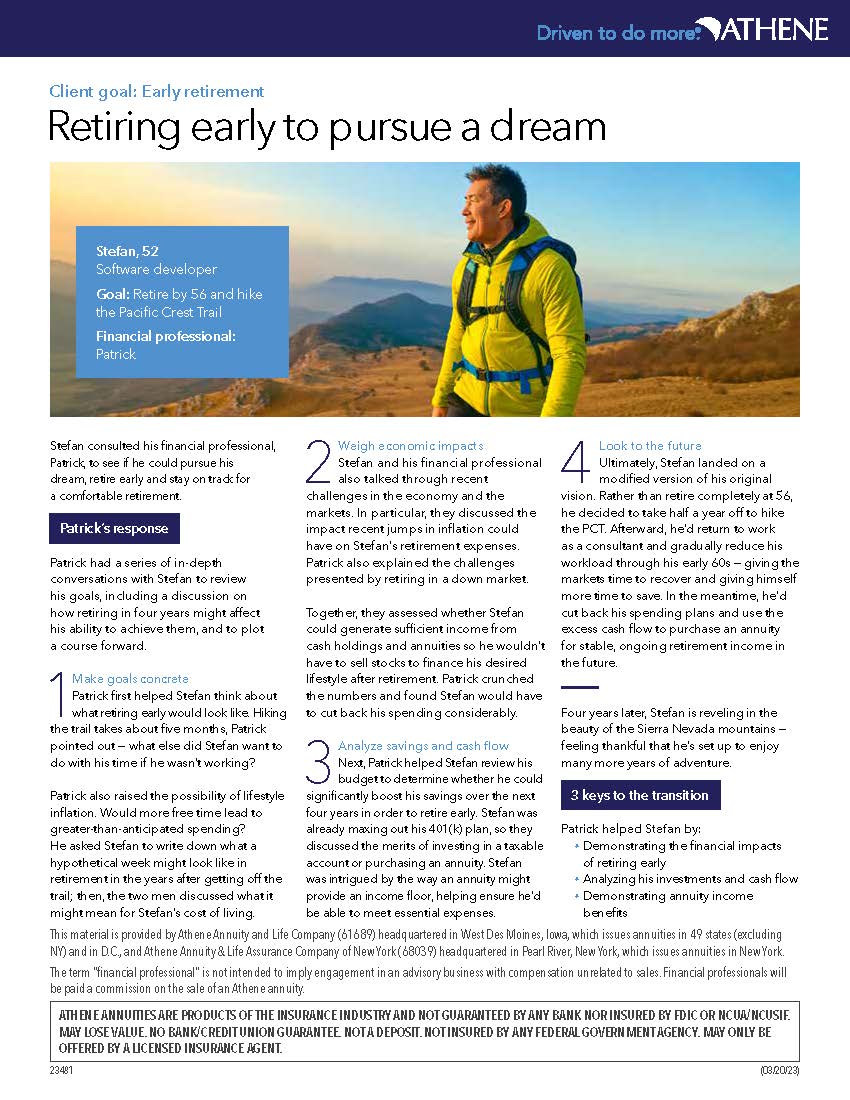

Follow the path financial professional, Patrick, takes to determine if his client, Stefan, can retire early to pursue bucket-list adventure hiking the Pacific Crest Trail.

Download case study

|

The closer retirement gets, the more some clients can see their dreams unfold. If they decide to pursue their dreams a little early, looking holistically at a client’s financial picture can help determine if early retirement is within reach.

- Review retirement goals and dreams to see what being retired looks like and how extra years pursuing life on their terms could impact their financial plan. For example, will extra free time mean extra spending or is a move on the horizon?

- Develop a flexible market strategy to help protect savings. Significant negative returns can take a toll on a client’s savings the closer retirement comes. Although market fluctuations are normal, adding an indexed annuity, like a fixed indexed annuity (FIA), to a retirement portfolio may help pursue growth opportunities and hedge against volatile markets.

- Prepare them for health care costs, including health insurance and higher health care costs in retirement. Help clients determine if their retirement income will be enough or if they could use a guaranteed income source, like an annuity, to help pay for expenses and curb inflation’s impact.

- Evaluate options for part-time work if the numbers don’t work in a client’s favor. Sometimes retirees miss working and a part-time job can provide structure and a sense of purpose.

- Talk about Social Security and how big of a role it will play in an early retiree’s income plan. Knowing how to maximize benefits could mean tens of thousands of dollars more in retirement income. With plenty of resources available, discuss options and the best time to file for Social Security.

Career change

Resigning for some people doesn’t always mean not working. It may mean changing careers and a pay raise. With 6 million Americans officially unemployed and 10.5 million job openings in the U.S., that’s over 1.7 unfilled positions per job seeker. More good news — half of the workers who changed employers between April 2021 and March 2022 received a 9.7 percent average wage increase.

|

How can you help clients make the most of a new job?

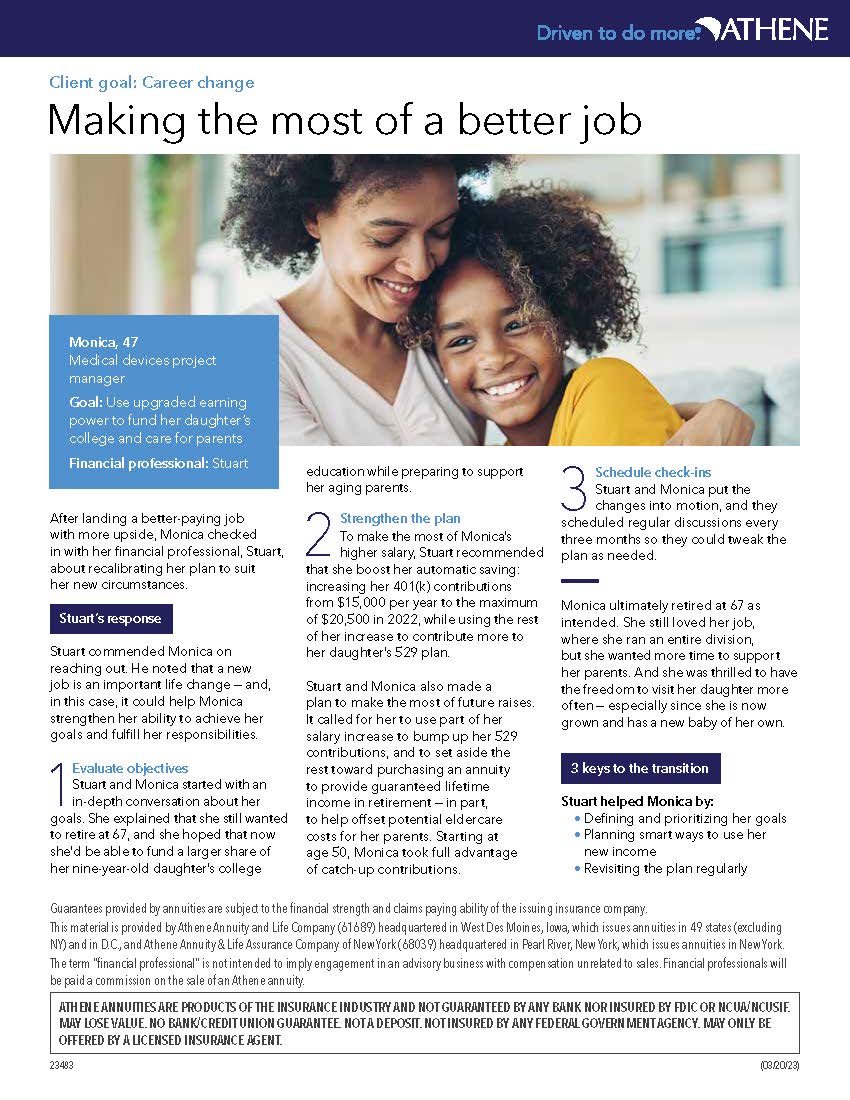

After landing a better position, Monica wants to use her new earning power to pay for her daughter’s college and care for her parents. Discover how her financial professional, Stuart, recalibrates Monica’s financial plan to maximize the higher salary.

Download case study

|

If a client finds a new career to prolong their working years or fill openings created by the Great Resignation, talk about these five factors to help smooth out their transition:

- Health insurance plans and costs – Encourage a health insurance plan review to see how costs compare. If the monthly premiums are different, or if the plan coverage differs, consider how to account for the change in their retirement savings strategy.

- Life and disability insurance needs and options – It’s easy to think there will be time to increase protection for loved ones — until there isn’t. Help clients switching jobs identify coverage gaps a career change may create.

- Retirement plans – Have a conversation about plan features, investment options, company match, including rules for eligibility, vesting and rollovers. Make sure a client switching jobs understands new plan options and impacts to a retirement plan overall.

- Other benefits, such as stock options, stock purchase plans and deferred compensation.

- Retirement plan adjustments – Will clients switching careers have the retirement income they’ll need? If there’s a deficit between assets and goals, it’s easier to make portfolio adjustments, such as adding a FIA to compensate before retiring.

New business

In 2021, a record 5.4 million new business applications were filed. That’s a 20 percent jump from 2020, already 24 percent higher than the previous year. The fact is resigning may be the right time and motivation to start a business.

|

Can you help clients pursue more meaningful work?

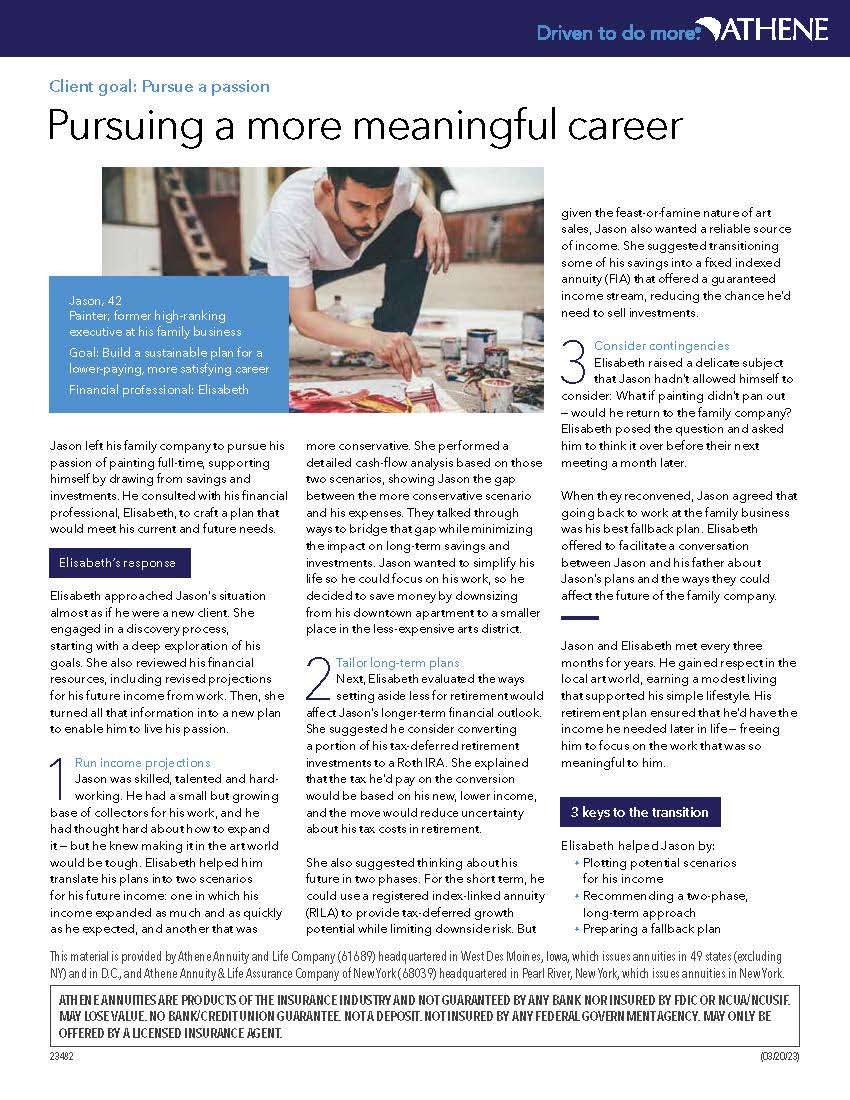

Yes. Here’s how financial professional, Elisabeth, helped her client, Jason. After reaching an executive level position, he chose to leave that life behind for a new career in the arts. See how they craft a plan that gives Jason the money to pursue his passion now and meet his future financial needs.

Download case study

|

If your clients decide to start a new business, here’s how you could help:

- Review business plans, startup costs, financing options and income projections.

- Counsel on sole proprietorship and LLC tax filing choices.

- Discuss the benefits of a solo 401(k).

- Talk about the income benefits of fixed indexed annuities.

- Assess their need for health, disability, liability, life and flood insurance.

Career gap years

While nearly half of working moms take a two-year break, on average, beyond maternity leave, these breaks aren’t just for women. At some time during their professional careers, 62 percent of employees have taken time out for job transitions, life transitions and caregiving. Help clients taking a career break stay on track financially by:

- Reviewing their goals, expenses and timelines.

- Look at income sources and a drawdown plan.

- Build a retirement checklist to help clients from feeling overwhelmed and track progress.

- Identify how they can keep saving for retirement.

- Find where to cut back on nonessential expenses.

Is the Great Resignation hurting your business?

If you notice that recruiting top talent or minimizing employee turnover is harder than it used to be, you’re probably not alone. Not only has the Great Resignation changed the workforce, it’s also affected the workplace. Competition for highly skilled professionals is intense, so it may take new strategies to stand out. Experts encourage three tactics to help employers attract skilled professionals — and keep them:

- Prioritize mentoring. Generally, highly skilled professionals get that way because they’re curious, open to learning and invested in their career. Since 94 percent of employees say they would stay at a company longer if it invested in their learning and growth, identify your employees’ current and future career goals. Work together to define skills they’ll need and work toward helping them acquire those.

- Invest in technology. Did you know employees who have the right technology to do their jobs are 230 percent more engaged? Post job openings on career sites like Indeed, Glassdoor and LinkedIn. Review your software, budget for upgrades and train employees to show your commitment.

- Prioritize work-life balance. The hybrid work model has boomed in popularity since the pandemic for flexibility and better work-life balance. It could also expand a candidate pool enticing potential candidates who live farther away. However, 95 percent of workers value flexible hours more than a hybrid work model. If it doesn’t suit your business, a compressed work week or job sharing are other ways to offer flexibility.

As everyone moves forward, there are opportunities for financial professionals to provide valuable guidance to their clients in addition to focusing on benefits that matter most to employees. Prioritizing both the work environment and helping clients navigate new situations may be the recipe for building the best team for your practice.

Insights on Athene Connect. Tips, tools and resources to grow your business by helping clients retire with confidence.