Read time:

3-minute

article

The hidden costs of cash

This content is categorized as:

For the first time in more than a decade, increases in the federal funds rate have delivered very attractive interest rates in money market accounts and other cash equivalents. As a result, many clients are holding onto unprecedented levels of cash — roughly $6.1T among U.S. households. That’s money that could be moved from the sidelines and into retirement vehicles with greater long-term growth potential.

U.S. Money Market Funds: 1/1/2013 - 7/31/2023

Source: Board of Governors of the Federal Reserve System (US), Money Market Funds; Total Financial Assets, Level [MMMFFAQ027S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MMMFFAQ027S, January 16, 2024.

Help your clients understand how they can achieve greater growth potential by putting excess cash to work. Here are some ways to start the conversation:

Acknowledge the advantages and disadvantages of having cash on hand

Cash can help in numerous ways:

- It’s liquid — cash can be used when and where it’s needed.

- It can be saved for emergencies — cash may be needed most when surprises pop up.

- It’s good for short-term savings — cash can be useful when planning for vacations, weddings or other life events.

- It helps provide peace of mind — cash can be comforting.

Cash can also be a burden:

- It has no long-term guarantees — rates on cash can change at any time as the short-term interest rate environment changes. If rates fall, interest earnings can too.

- It can result in a loss of purchasing power — if returns on cash are lower than the rate of inflation, clients could lose purchasing power.

- It can be ripe for missed opportunities — holding on to excess cash may mean missing out on potential gains from other retirement vehicles.

Help clients to make their cash make sense

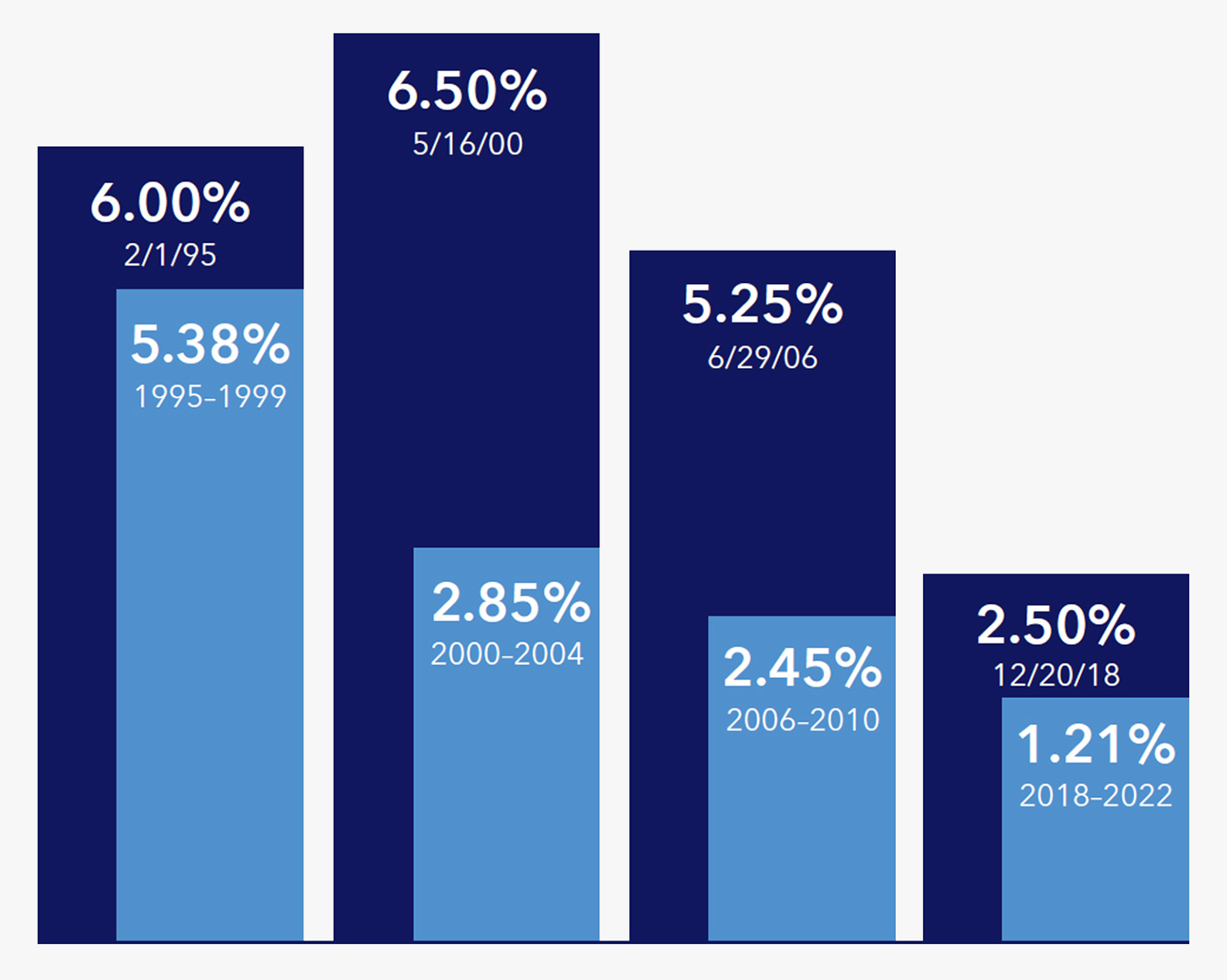

While having cash on hand has its benefits, having too much can be detrimental. Rates have the ability to decline, as demonstrated over the last 30 years.

Peak Federal Funds Rate vs. 5-Year Average After Peak

Source of dates: https://www.chathamfinancial.com/insights/historical-interest-rate-tightening-cycles

Source of rates: https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

Average short-term rates were substantially lower in the five years after the end of prior Federal Reserve rate hiking cycles.

While the best accounts to move cash into will depend on the individual client, two options that can be discussed are fixed and fixed indexed annuities — which combine protection features with greater growth potential.

These solutions may also have additional benefits:

Protection from market downturns

Interest growth on a tax-deferred basis

Other features such as death benefits and confinement benefits* for a qualified care facility

The biggest difference between fixed and fixed indexed annuities is how the interest is credited. Compared to cash, fixed annuities provide a guaranteed rate of return over a longer period of time — which allows clients to take advantage of the high interest rate environment by locking in today’s rates.

Fixed indexed annuities give clients the potential to earn interest based in part on the performance of an external market index, such as the S&P 500. This allows them to take advantage of higher growth potential.

By providing the information, resources and support your clients need, you can help make their retirement remarkable. Athene has a cash worksheet and rates cycle flyer to help tell the “Hidden Costs of Cash” story. Reach out to the Athene Sales Desk for additional support.

Insights on Athene Connect. Tips, tools and resources to grow your business by helping clients retire with confidence.

* This benefit is NOT long-term care insurance nor is it a substitute for such coverage.

Under current tax law, the Internal Revenue Code already provides tax deferral to qualified money, so there is no additional tax benefit obtained by funding a qualified contract, such as an IRA, with an annuity; consider the other benefits provided by an annuity, such as lifetime income and a Death Benefit.

Withdrawals and surrender of taxable amounts are subject to ordinary income tax, and except under certain circumstances, will be subject to an IRS penalty if taken prior to age 59½.

The S&P 500® Index (the “Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and has been licensed for use by Athene Annuity and Life Company (“Athene”). S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Athene’s products are not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.