Read time:

3-minute

article

How fixed indexed annuities protect clients against downside risk

This content is categorized as:

Investing directly in the market exposes investors to both volatility and market risk. This uncertainty can make it difficult to create a reliable retirement income plan.

As they seek solutions that can help build their savings for the future, your clients may look for growth potential while protecting those assets from loss during a market downturn. "There are not a lot of products offering that combination of benefits,” explains Chris Grady , Executive Vice President and head of retail sales at Athene USA.

Fortunately, adding a fixed indexed annuity (FIA) to a financial strategy can help bring growth opportunities and protection from market loss to your client’s retirement income plan.

Growth and protection with FIAs

A FIA is not invested directly in the market. Instead, it tracks market indices, allowing some exposure to market gains while avoiding market downside. Because of the structure, a FIA can help clients protect their savings, ride out volatile markets and manage risk.

“FIAs allow clients to balance growth in expanding markets with protection in contracting ones.”

- Chris Grady, EVP and head of retail sales, Athene USA

How FIAs work

Since a FIA is linked in part to the performance of an external market index, it allows clients to grow their money when markets are up — and lock in gains when they decline. That unique structure means FIAs offer:

- Growth – When the markets rise, the annuity’s value can grow. Growth potential is offered through the opportunity to earn interest credits linked in part on a percentage of the upward movement of an external market index.

- Protection – Earned interest credits are locked in and cannot be lost, even if the market goes down. It’s possible to earn zero percent interest in any given interest crediting period, but a client would never earn less than zero.

Only 22 percent of Americans realize that annuities offer protection in down markets, according to a survey conducted for Athene.

- Guarantees - When markets decline, guarantees in the annuity, such as a FIA’s characteristic zero-return floor, provide protection from loss. In the following example, you can see how it keeps returns from going through the floor. A client pays a $100,000 premium for a FIA that’s indexed to the S&P 500®. In one year, the index loses 40 percent in value, yet the client retains $100,000 in principal.

| Principal protection: A FIA’s zero-return floor in action |

| Premium paid |

$100,000 |

| Benchmark market index |

S&P 500® Index |

| S&P 500® annual returns |

40% |

| Zero-return floor guarantee |

Protection against 40% market loss |

| Interest credits earned |

0% |

| Principal retained |

$100,0000 |

This hypothetical example is for informational purposes only and is not indicative of past, nor intended to predict, future performance of any specific annuity product or interest crediting method.

FIA growth versus the S&P 500®

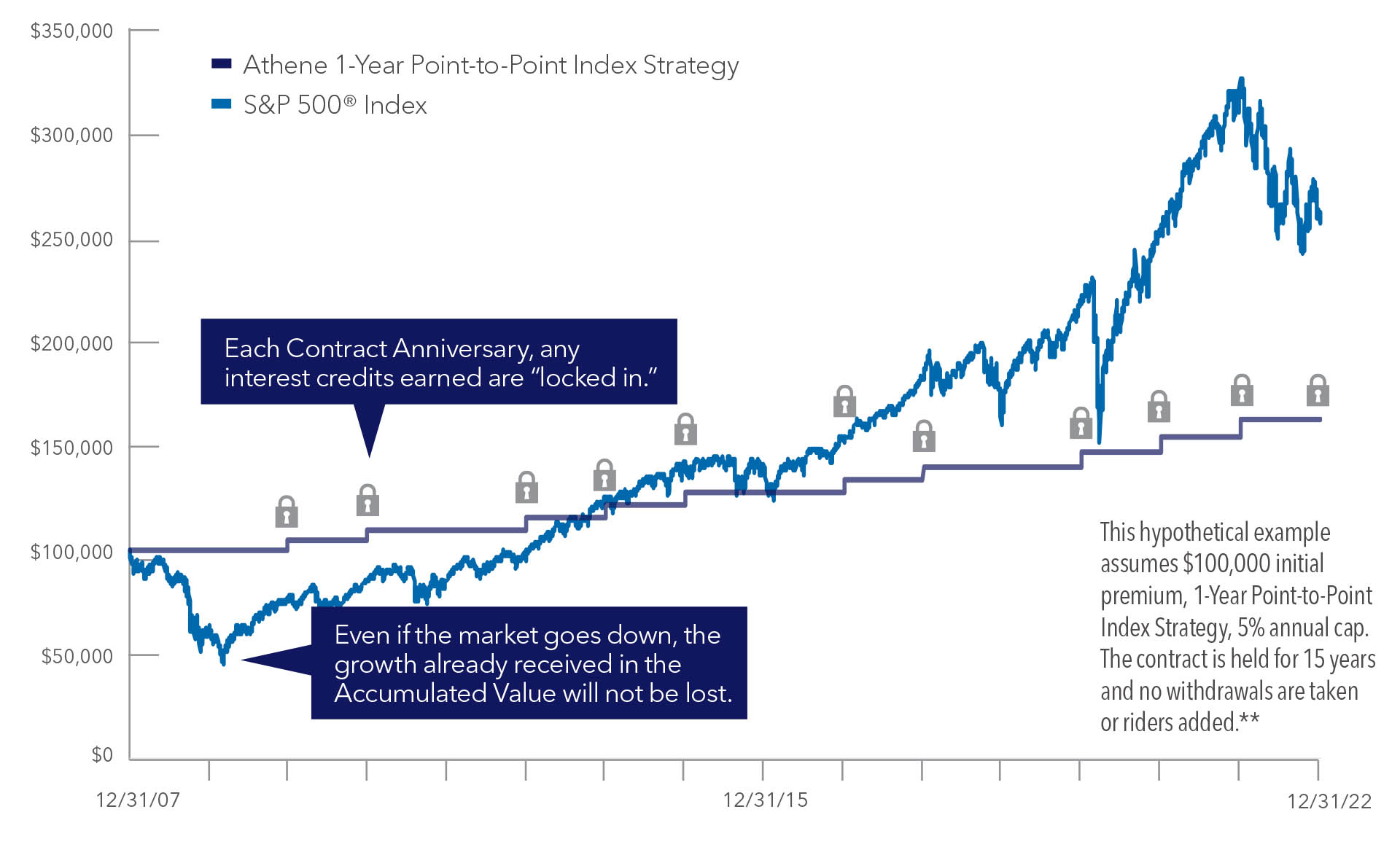

This graph demonstrates how the S&P 500®’s historical performance over 10 years compares against growth of an FIA tracking the same index.

Though the amount of interest a client can earn with a FIA typically fluctuates depending on the specific terms of the annuity contract, performance is more stable than in the underlying index. This stability provides growth opportunities without the risk of loss due to market downturns.

Locking in gains provides dependable growth without market loss

Premium that is allocated to one of the Index Strategies will receive interest that is calculated in reference to the upward movement, if any, of an external market index, modified by limitations such as a Cap Rate, an Annual Spread, or Participation Rate. This hypothetical example is for informational purposes only and is not indicative of past, nor intended to predict future performance of any specific product including an annuity; nor is it intended to represent any particular product or interest crediting method. The annual cap limits interest credits to 4% each term. Fixed and indexed annuities are not stock market investments and do not directly participate in any stock or equity investments. Market indices may not include dividends paid on the underlying stocks, and therefore may not reflect the total return of the underlying stocks. Clients who purchase indexed annuities are not directly investing in a stock market index.

Securing a client’s financial future

Planning for a secure retirement requires a personalized approach. “That’s why it is important for financial professionals and their clients to consider savings vehicles that can provide growth and protection …,” suggests Mike Downing, Executive Vice President, Chief Operating Officer, and Chief Actuary for Athene.

The markets are volatile, but your clients’ financial future doesn’t have to be. Explaining how a FIA adds protection and growth opportunities to a financial plan may offer the security some clients want.

Insights on Athene Connect. Tips, tools and resources to grow your business by helping clients retire with confidence.