Read time:

4-minute

article

Diversify fixed indexed annuities with custom indices

This content is categorized as:

You know not to “put all your eggs in one basket.” Instead, you want to give your clients a basket of exposure with varying characteristics, risks and return potential that could help shield them from wide, unpredictable market swings as they strive to make steady progress toward their financial goals.

Optimize FIA outcomes with custom indices

|

Download our exclusive Custom Index Strategy Guides for compelling evidence about how these powerful indices can help:

- Manage market volatility

- Enhance participation rates

- Offer potentially better returns

Get your strategy guides

|

|

Your clients may benefit from diversifying inside of their annuities. If they’re interested in protection from market losses and participation in market gains that a fixed indexed annuity (FIA) offers, choosing from a combination of benchmark and custom indices can be beneficial. According to research conducted for Athene by The Index Standard, this strategy can help reduce volatility and offer long-term diversification advantages.

The benefits of diversification

Spreading allocations across multiple custom index options may provide smoother, risk-managed returns, especially if the indices are not correlated — in other words, the less their fluctuations match, the better.

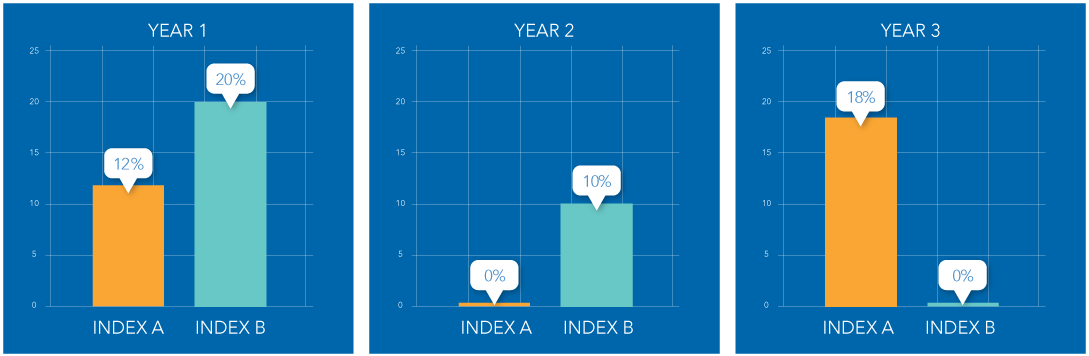

Here’s an example using returns from custom index options over three years.

Both indices have average annual returns of 10 percent. Index B is more volatile (8.2%) than Index A, but they move in opposite directions. In other words, they aren’t correlated.

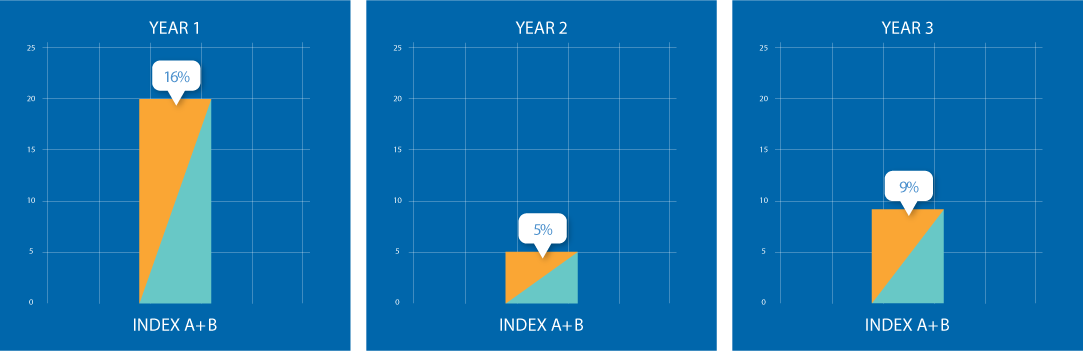

Now let’s put the two custom index options together in the same basket. Your client has equal exposure to each. Here are the combined returns for each year.

The average annual return is the same: 10 percent. But the combined volatility is much lower (4.6%). That’s because the indices’ fluctuations offset each other, creating a smoother overall return.

Hypothetical examples are for informational purposes only and not indicative of past, nor intended to predict, future performance of any specific annuity product or interest crediting method.

Is it time to rethink the S&P 500®?

What if your client had a FIA with two different indices selected — one tracking a standard benchmark index, the other global stocks? They would have some diversification and the potential for more satisfactory returns.

Nearly all FIAs include interest crediting strategies tied to the S&P 500 index, which is widely used to represent the overall U.S. equities market. But it wasn’t designed to meet the needs of FIA owners. That’s because even though the S&P 500 historically has returned approximately 10 percent a year, short-term returns can vary widely.

Since 1957, when the modern S&P 500 was born, returns over any 1-year period ranged anywhere from a loss of almost 37 percent to a gain of almost 45 percent with an average annualized return of 10.26 percent.1 For 10-year periods in the last 20 years, the returns have been more stable with average annualized returns of 13 percent in the decade between 2013 and 20232 and 10 percent in the 20 years between 2003 and 2023.3

That 10-year number is important, because it’s the typical time horizon for many FIAs. If your client owns a FIA, they likely value the security and stability of the product. And they might not find the potential to lose 6 percent in any given year on the FIA’s underlying index a suitable risk, since it would mean a 0 percent credit for that year. However, choosing a custom index inside a FIA helps reduce the chance of a 0 percent credit and may help provide more stable returns every year.

Controlling risk in custom indices

But if you apply a custom index to a FIA, you’re adding diversification to the mix. Custom indices with volatility control mechanisms automatically monitor the volatility of the assets within the index and dynamically adjust to control the index’s exposure to volatility.

But if you apply a custom index to a FIA, you’re adding diversification to the mix. Custom indices with volatility control mechanisms automatically monitor the volatility of the assets within the index and dynamically adjust to control the index’s exposure to volatility.

The custom indices within FIAs target a desired level of volatility. When the underlying risky/growth asset becomes more volatile, the mechanism shifts the allocation from the high-risk asset to a stable asset (like cash). When the custom index becomes less volatile, the opposite occurs.

No matter what’s happening in the market, however, the custom index’s volatility control mechanism seeks to limit volatility to a preset “target” level. As a result, your client might not enjoy all the gains when the market rises, but they’re better cushioned against major drops, leading to potentially smoother returns.

You could consider a FIA that includes both a custom index and the S&P 500 to increase the diversity of a client’s annuity allocations. You have a lot of options for custom indices today: they can be based on U.S. stocks only, global stocks, and a mix of stocks, bonds and other types of assets. When the two indices are combined within the FIA, the amount of combined fluctuation decreases, generally smoothing out returns.

For clients seeking principal protection from market loss and growth potential, modern FIAs with custom indices as well as benchmark indices provide more diversification. Determining the appropriate FIA and custom index selection needed for a client's "basket" can help them build a remarkable retirement.

Get more comfortable with custom indices from the insights and analysis in our exclusive Custom Index Strategy Guides: Optimizing Retirement Outcomes.

Insights on Athene Connect. Tips, tools and resources to grow your business by helping clients retire with confidence.

1NYU Stern. Historical Returns on Stocks, Bonds and Bills: 1928–2023. January 2024.

2S&P 500 Data. Stock market returns between 2013 and 2023. Accessed June 2024.

3S&P 500 Data. Stock market returns between 2003 and 2023. Accessed June 2024.

© 2024 Athene. All Rights Reserved.

Material in the INDEX INSIGHTS whitepapers includes research commissioned by Athene and conducted by The Index Standard®.

A diversified allocation does not ensure positive interest credits in any given year.

Indexed annuities are not stock market investments and do not directly participate in any stock or equity investments. Market indices may not include dividends paid on the underlying stocks, and therefore may not reflect the total return of the underlying stocks; neither an index nor any market-indexed annuity is comparable to a direct investment in the equity markets.

The S&P 500® Index (the “Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and has been licensed for use by Athene Annuity and Life Company (“Athene”). S&P®, S&P 500®, SPX®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Athene’s products are not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.